Practical Tips to Avoid Payment Fraud for Businesses

Businesses are increasingly concerned about payment fraud. Modern hackers use advanced strategies to steal money and data quickly and efficiently. How will you secure your transactions against the newest threats?

This article provides a comprehensive guide to payment fraud protection for businesses. With these tips, you’ll be able to relax knowing that your transfers are going to the right people!

What is Payment Fraud?

Payment fraud refers to the illegal manipulation of bank details to send or receive payments. It’s a significant problem for businesses, causing financial losses and legal consequences.

A financial team might not notice they typed in the wrong account number. Or, a third-party vendor looks legitimate but is actually a scammer hoping to receive an invoice with payment details. These examples show how easy it is to fall victim to fraud.

These situations come with significant consequences. If you are accused, you will have to spend substantial amounts of money on legal help to defend yourself, hurting your reputation and slowing the growth of your business. These repercussions are the reason that companies take preventing payment fraud seriously.

The Warning Signs of Payment Fraud

If you can spot fraud early, you can prevent a much larger problem. Here are the most common warning signs:

1. Suspicious Invoices

Imagine you receive an invoice that looks slightly off. It appears to be from a trusted partner but looks different than usual. Maybe the address is wrong, the message contains multiple misspellings, or it’s for a product you never provided.

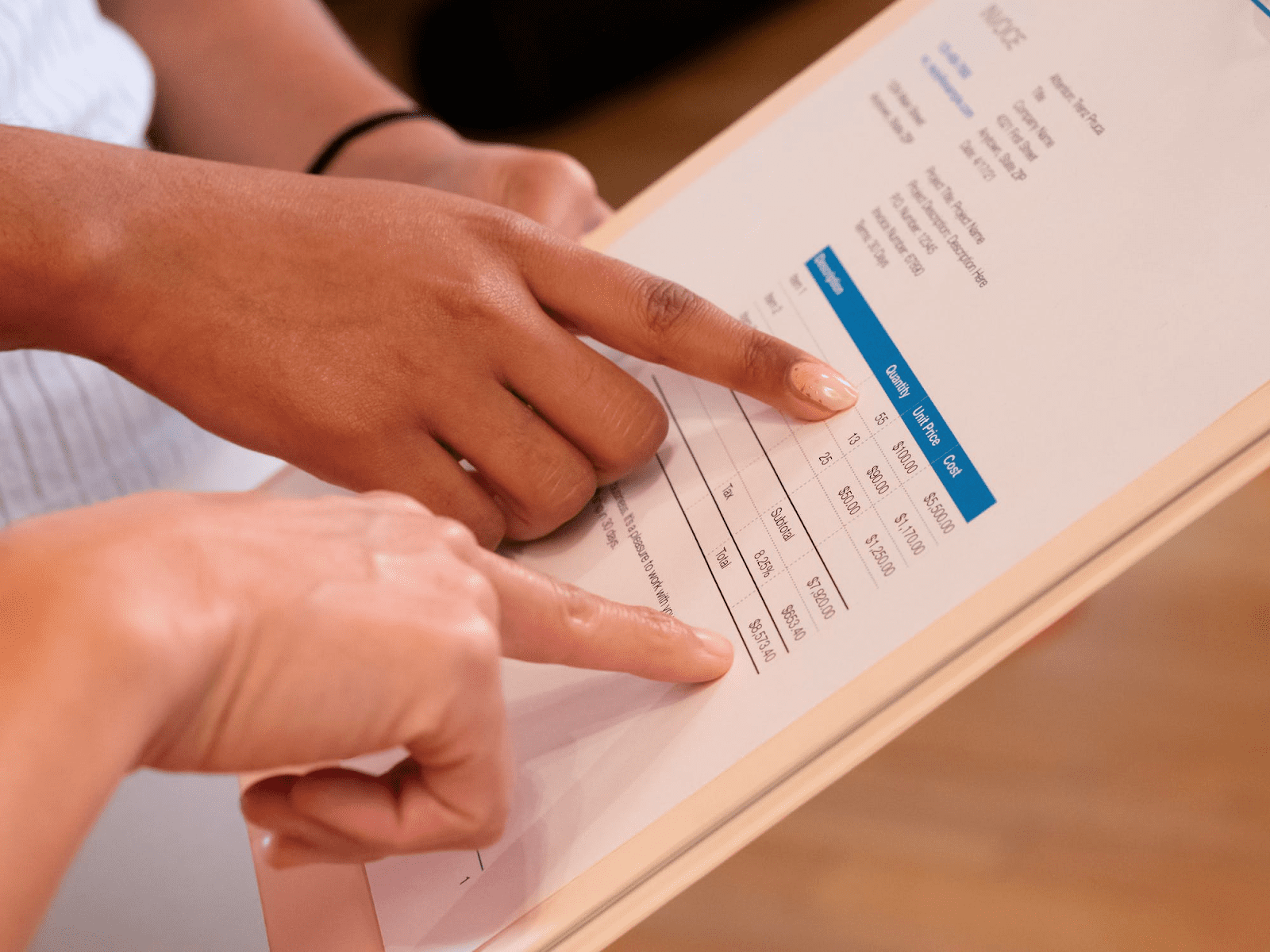

If an invoice looks strange, triple-check that it’s actually coming from the person you think it is. Fraudulent invoices are among the most common ways hackers convince companies to send them large sums of money.

2. Sharing Sensitive Information Through Email

If you ever receive an email asking you to provide bank details, inspect it closely and contact the sender to ensure it’s legitimate and not a scam attempt. Never share any personal information through email!

3. Unexplained Transactions

If you see transactions on financial statements that can’t be explained, you should deep dive through your statements as soon as possible. Chances are, you have been hacked, and someone is using your company accounts to make fraudulent purchases.

How to Prevent Payment Fraud

Thankfully, there are ways you can prevent payment fraud. They include:

1. Validate Transactions

The best way to protect against fraud is to ensure every transaction is legitimate. This means checking that all information is correct and that you’re sending funds or details only to trusted third-party vendors whose identities you have verified.

One of the most essential methods of verifying transactions is never to overlook bank account number validation. This information is often long and random, meaning it is easy to make a mistake.

2. Don’t Use Public Networks

Public wifi presents a significant security risk to your personal information. Hackers can easily intercept data travelling to and from unsecured networks and then use those details for fraudulent activity.

If you must use a public network, keep the time you spend on it brief and try not to share private information through emails and messages or log into any bank account. You can also use a VPN for added protection.

3. Review Statements Regularly

You should also review financial statements as regularly as you can. If you see something that looks out of the ordinary or unexpected, look into it immediately.

The most ideal way of doing this is to have a team that checks statements as they come in. This way, you can spot irregularities as soon as they happen rather than a few weeks or months later.

4. Employee Training

One of the main ways hackers get a company’s bank information is through employees willingly giving it away, thinking they are sending details to a trusted third-party vendor, a bank, or another such source. Hackers pose as reputable senders to trick people.

You can best combat this by training your employees to recognize false emails and messages. Instruct them never to share bank details through email and always triple-check to be sure any communication is genuine and not fraudulent.

5. Deactivate Old Employee Logins

If an employee leaves the company, deactivate their login credentials as soon as possible. Even if the old employee doesn’t have malicious intentions, their username and password present a security risk since they will remain unchanged and unchecked for years.

Conclusion

Payment fraud is a real issue facing businesses in today’s digital world. Companies everywhere face increased online threats from hackers trying to gather and use bank details for fraudulent activities.

The tips in this guide will help your business stay safe from payment fraud!